Icelandic Kronur: Lessons from a Failed Carry Trade

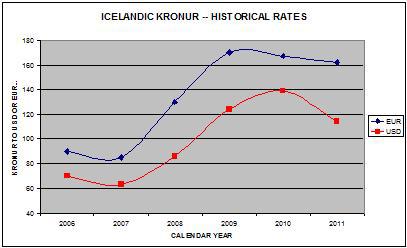

A little more than two years ago, the Icelandic Kronur was one of the hottest currencies in the world. Thanks to a benchmark interest rate of 18%, the Kronur had particular appeal for carry traders, who worried not about the inherent risks of such a strategy. Shortly thereafter, the Kronur (as well as Iceland’s economy and banking sector) came crashing down, and many traders were wiped out. Now that a couple of years have passed, it’s probably worth reflecting on this turn of events.

Forex Win to Loss Ratios

Better to Work with a Systematic Approach

Good Trading System

How Profitability of System can be Determined?

Forex System with High Win/Loss Ratio

What is PIP?

Forex Markets Focus on Central Banks

Over the last year and increasingly over the last few months, Central Banks around the world have taken center stage in currency markets. First, came the ignition of the currency war and the consequent volley of forex interventions. Then came the prospect of monetary tightening and the unwinding of quantitative easing measures. As if that wasn’t enough to keep them busy, Central Banks have been forced to assume more prominent roles in regulating financial markets and drafting economic policy. With so much to do, perhaps it’s no wonder that Jean-Claude Trichet, head of the ECB, will leave his post at the end of this year!

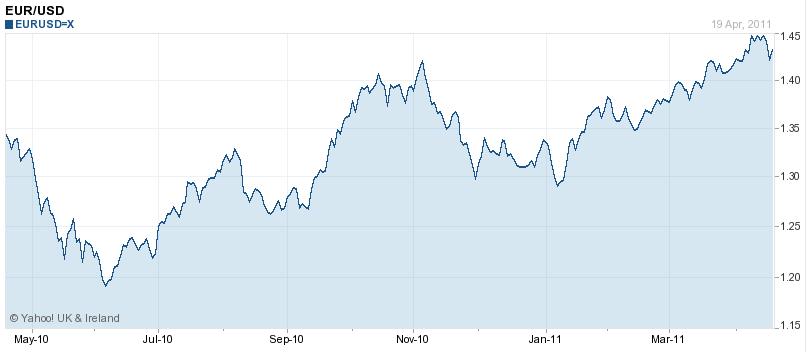

Time to Short the Euro

Over the last three months, the Euro has appreciated 10% against the Dollar and by smaller margins against a handful of other currencies. Over the last twelve months, that figure is closer to 20%. That’s in spite of anemic Eurozone GDP growth, serious fiscal issues, the increasing likelihood of one or more sovereign debt defaults, and a current account deficit to boot. In short, I think it might be time to short the Euro.